Amex Mobile App: Enhancing Wallet Experiences

PROJECT OVERVIEW

As part of the Wallet Experience team, I worked on features aimed at deepening CardMember engagement, streamlining digital payments, and strengthening security. My scope covered card provisioning journeys, new payment features, and security enhancements, designed for both iOS and Android in alignment with Amex’s Native Design Language (NDL) and brand guidelines.

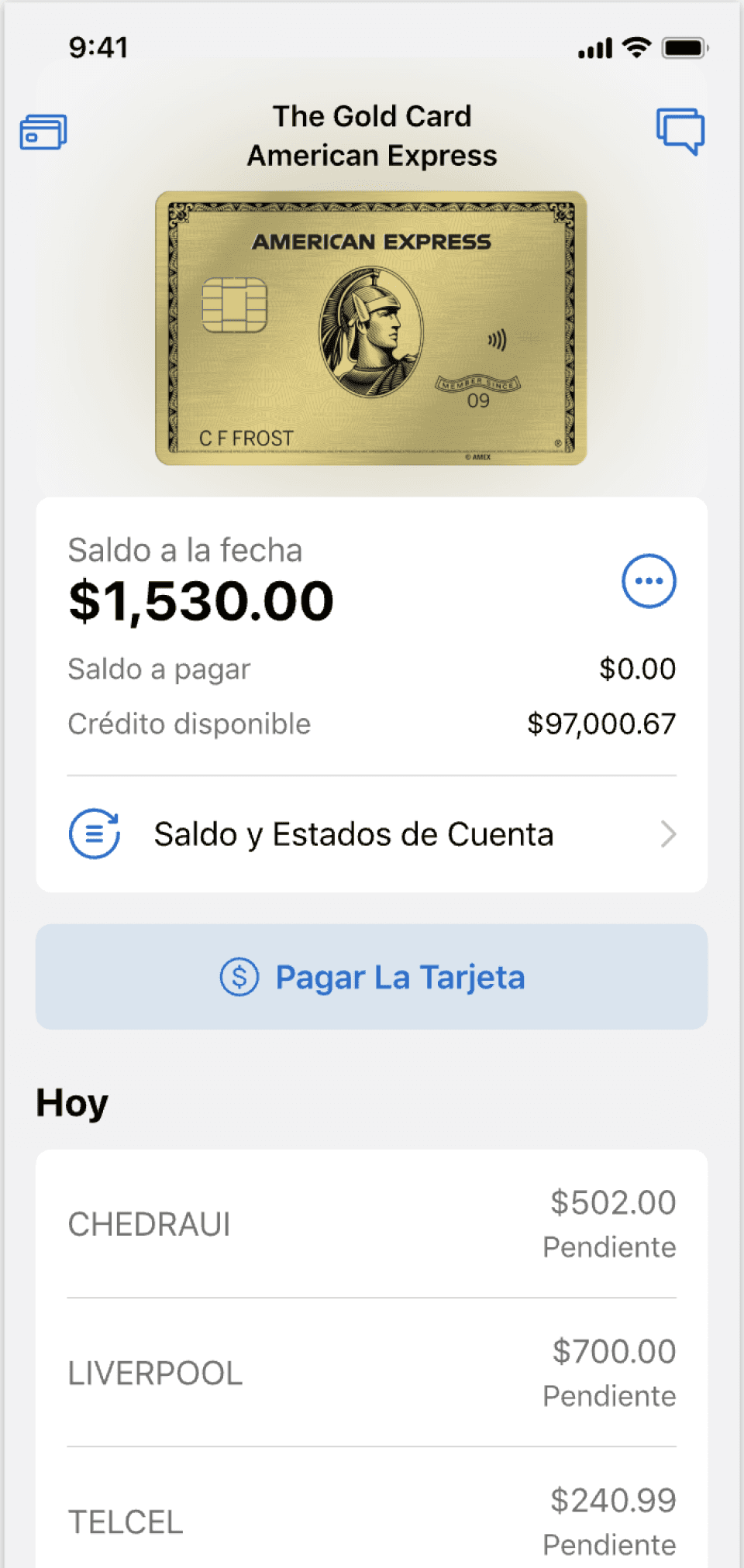

The Wallet Experience team’s strategic goal was to increase digital share of billings by expanding native mobile wallet opportunities that drive CardMember satisfaction, engagement, and revenue. Guided by market research, we identified opportunities to introduce Digital Card and Numberless Card, while exploring future concepts such as Subscription Hub and Spending Limit.

THE CHALLENGE

Despite Amex’s strong global brand presence, the mobile wallet offering lagged behind competitors, limiting engagement, reducing card usage opportunities and risking lost of share to competitors with broader merchant integration and secure features for card transactions.

Goal

Increase wallet provisioning rates by improving flow efficiency and discoverability

Expand wallet opportunities and engagement in the Wallets & Merchants space.

Enhance security through innovations like Digital Cards and Numberless Cards.

Explore new value propositions such as Subscription Hub and Spending Limits to strengthen Amex’s competitive edge.

IMPACT

Strengthened Amex’s competitive positioning by aligning payment capabilities with market leaders.

UK: Digital Card POC launched internally in 2022 to 20 Amex colleagues.

Mexico: Digital Card POC rolled out in Q1 2023 to 50K existing CardMembers.

MY ROLE

Within the Wallet Experience team, I designed and optimised features that simplify card provisioning, improve digital card security, and expand Amex card usage. This included preparing market-specific prototypes for usability testing, collaborating with product managers, and exploring opportunities around recurring payments, spending limits, and virtual cards.

Key contributions:

Conducted competitor analysis to identify opportunity gaps.

Delivered UX recommendations and research-backed design solutions.

Designed mobile screens for iOS and Android, considering both light and dark modes.

Produced InVision prototypes in English (UK/US) and Spanish (Mexico) for usability testing.

Created illustrations/animations to support recognition and comprehension.

Collaborated with Amex’s Lead Product Designer in weekly design reviews to ensure brand and NDL alignment.

Partnered closely with product owners to refine designs based on usability feedback.

EXPERTISE

Stakeholder Management

Product Design

Prototype

PROJECT DETAILS

Client: American Express

Role: UI/UX Designer

Team: Product Owner, Android and iOS Developers

Tools: Sketch, Invision, Adobe Illustrator

Timeframe: Dec 2021 - Mar 2023

What I worked on

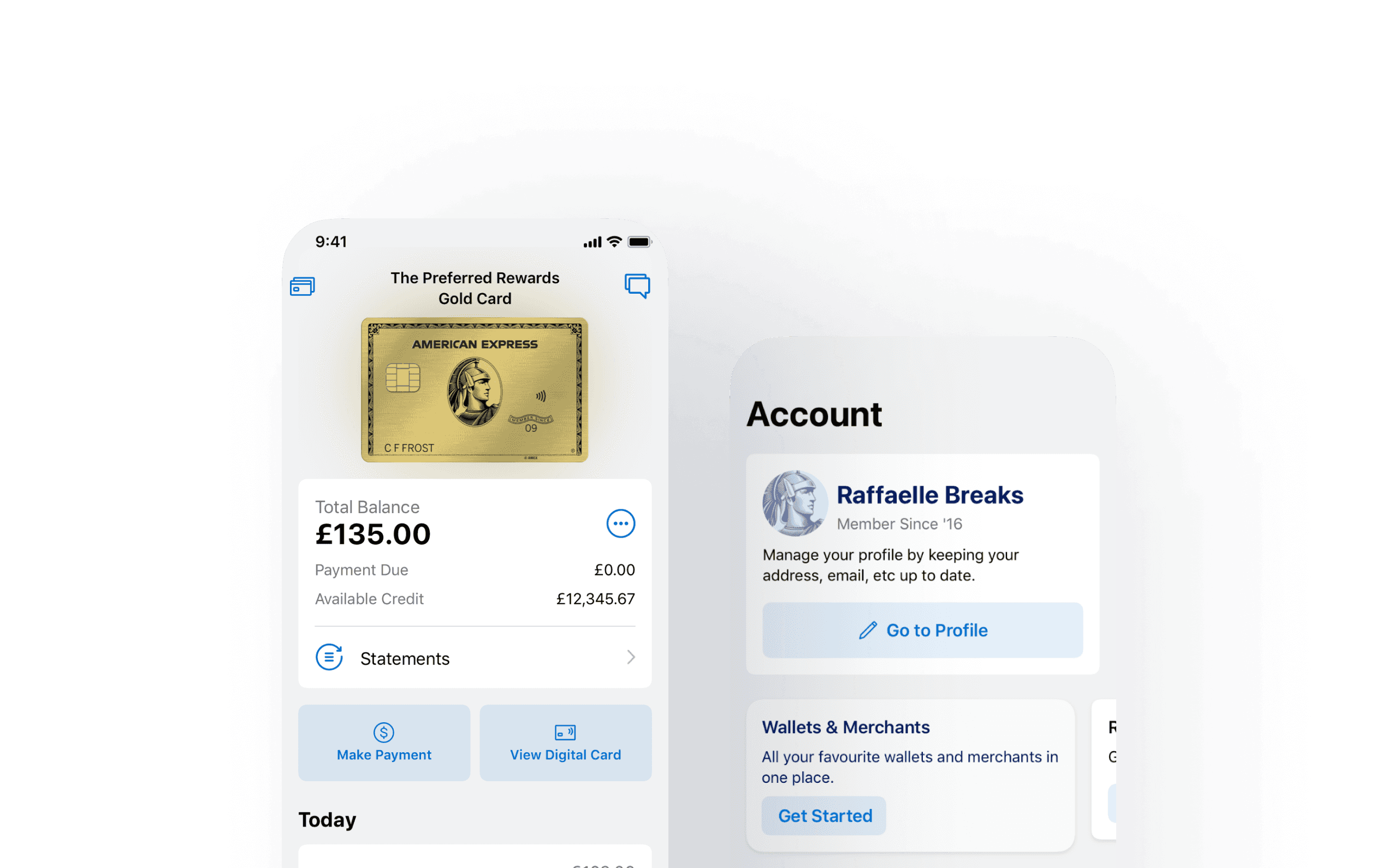

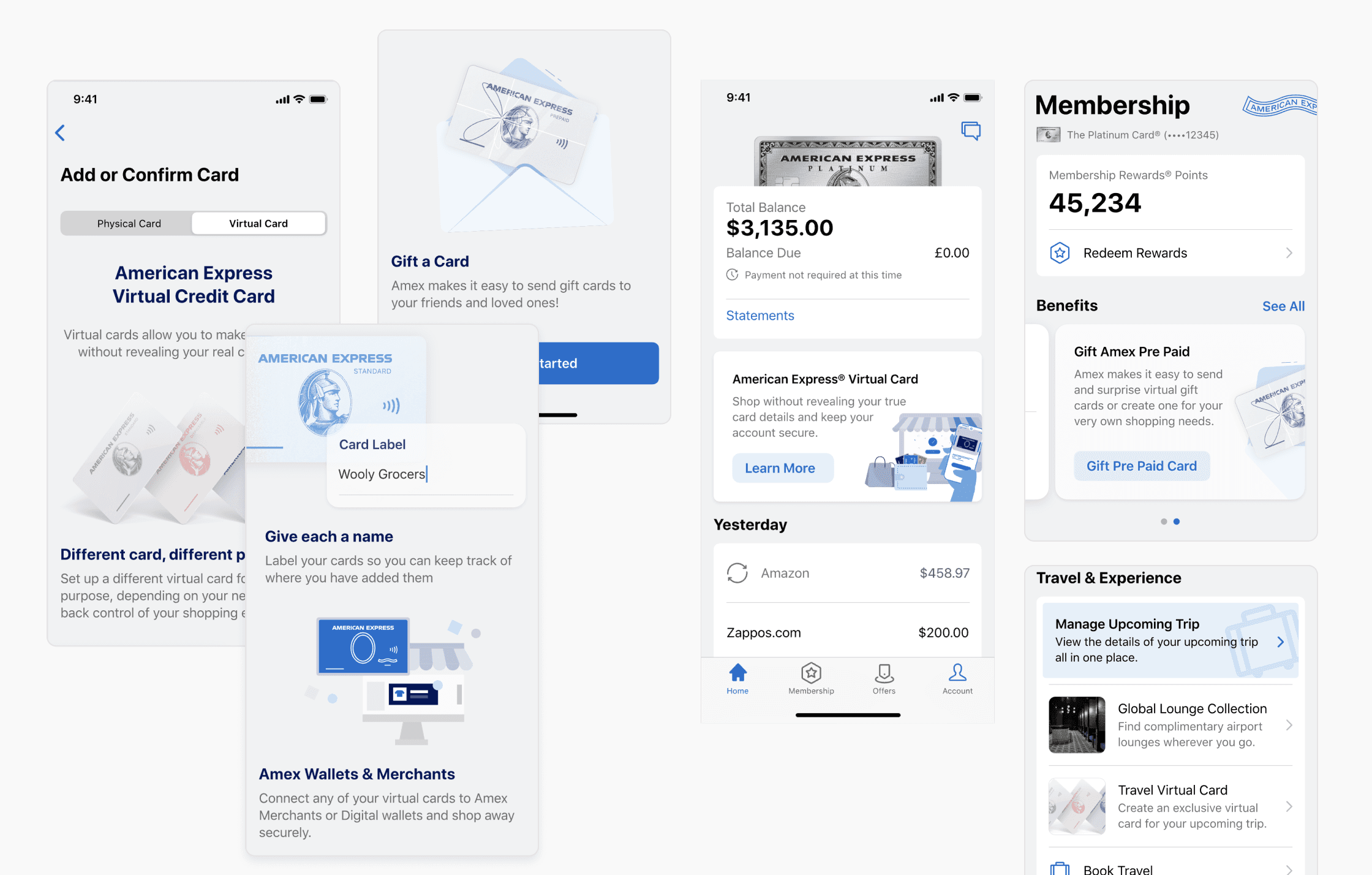

Wallets & Merchants: Consolidated Card Provisioning Journey & Broader Merchant Coverage

Designed a centralized wallet hub for Card Members to add their AMEX card to Apple Pay, Google Pay, PayPal, and major merchants from a single, streamlined flow.

Enabled faster provisioning by removing manual card selection for single card holders.

Identified and designed multiple in-app touch points to drive contextual adoption, including prompts in the Offers tab and merchant offer pages.

Previously, CardMembers could only provision their cards to Apple Pay and PayPal, each under separate entry points within the app. To meet competitive benchmarks where rivals support provisioning to platforms like PayPal, Apple Pay, Google Pay and Amazon, Amex needed to expand its merchant partnerships.

Integrating these platforms into a centralised Wallet space would deepen CardMembers’ relationships with merchants, build confidence in secure transactions, and increase both spend propensity and app engagement. To maximise adoption, the experience was designed to surface provisioning prompts at contextually relevant moments, making the process feel seamless and intuitive.

What we learned

From PayPal provisioning funnel analysis

US market (Feb 2022)

High drop-off at T&Cs screens (40%)

CardMembers often abandoned the process when faced with long, standalone T&Cs. We tested alternative patterns, such as integrating the content into a bottom sheet alongside the card selection screen, to make the step feel less disruptive.

Low provisioning success rates (32%)

Limited discoverability meant fewer CardMembers reached the provisioning flow. To address this, we designed multiple access points, including merchant-linked offers and in-app marketing placements, to increase both awareness and conversion.

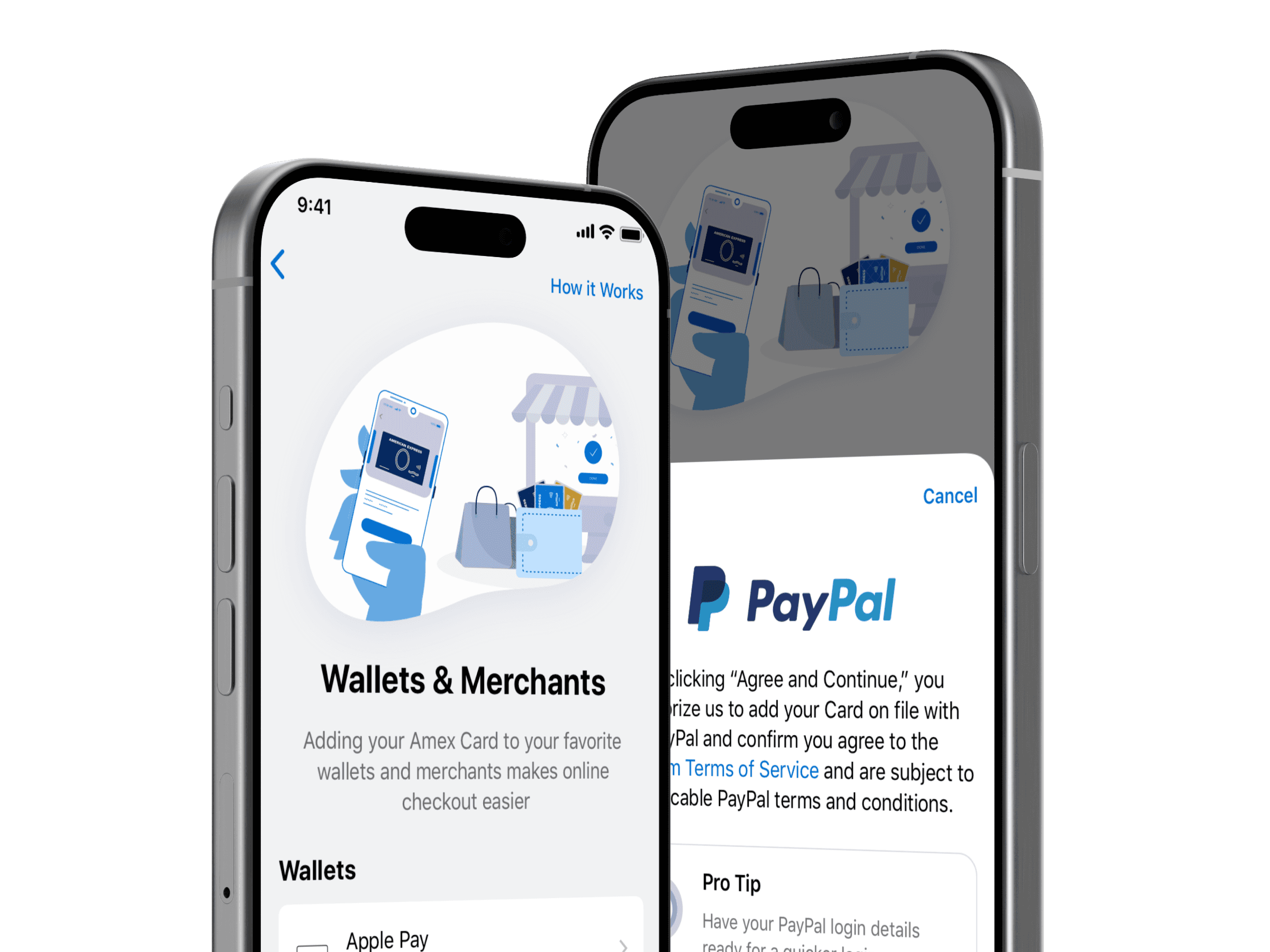

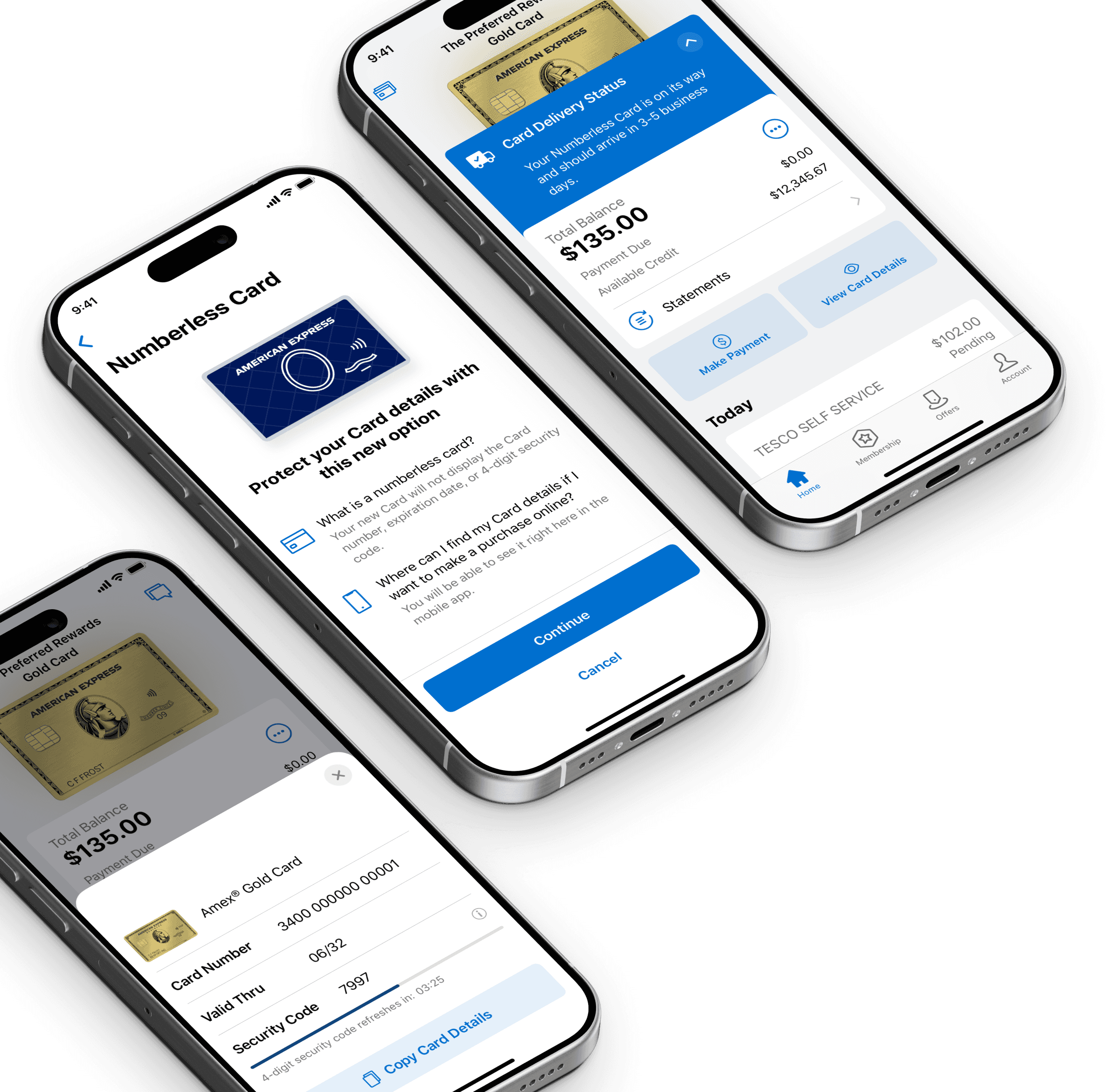

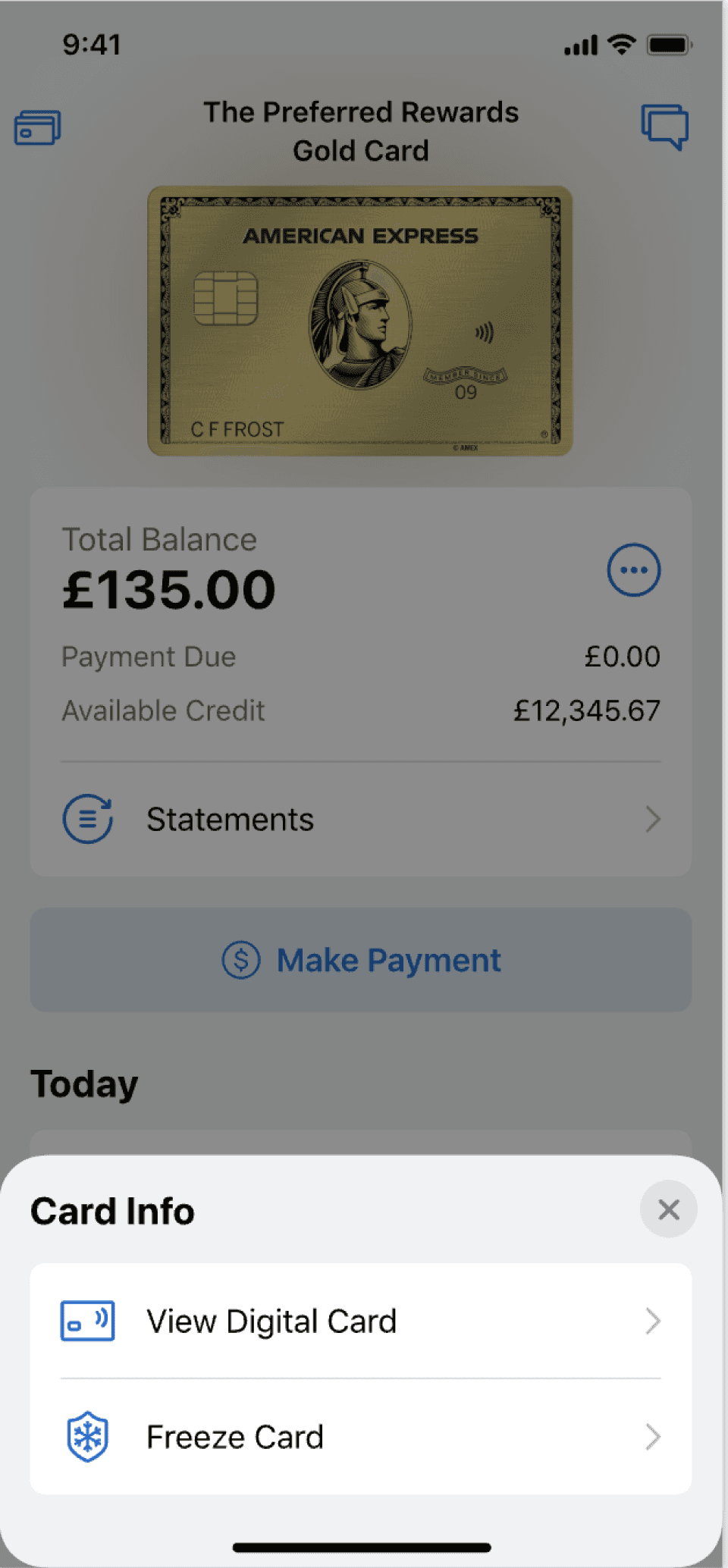

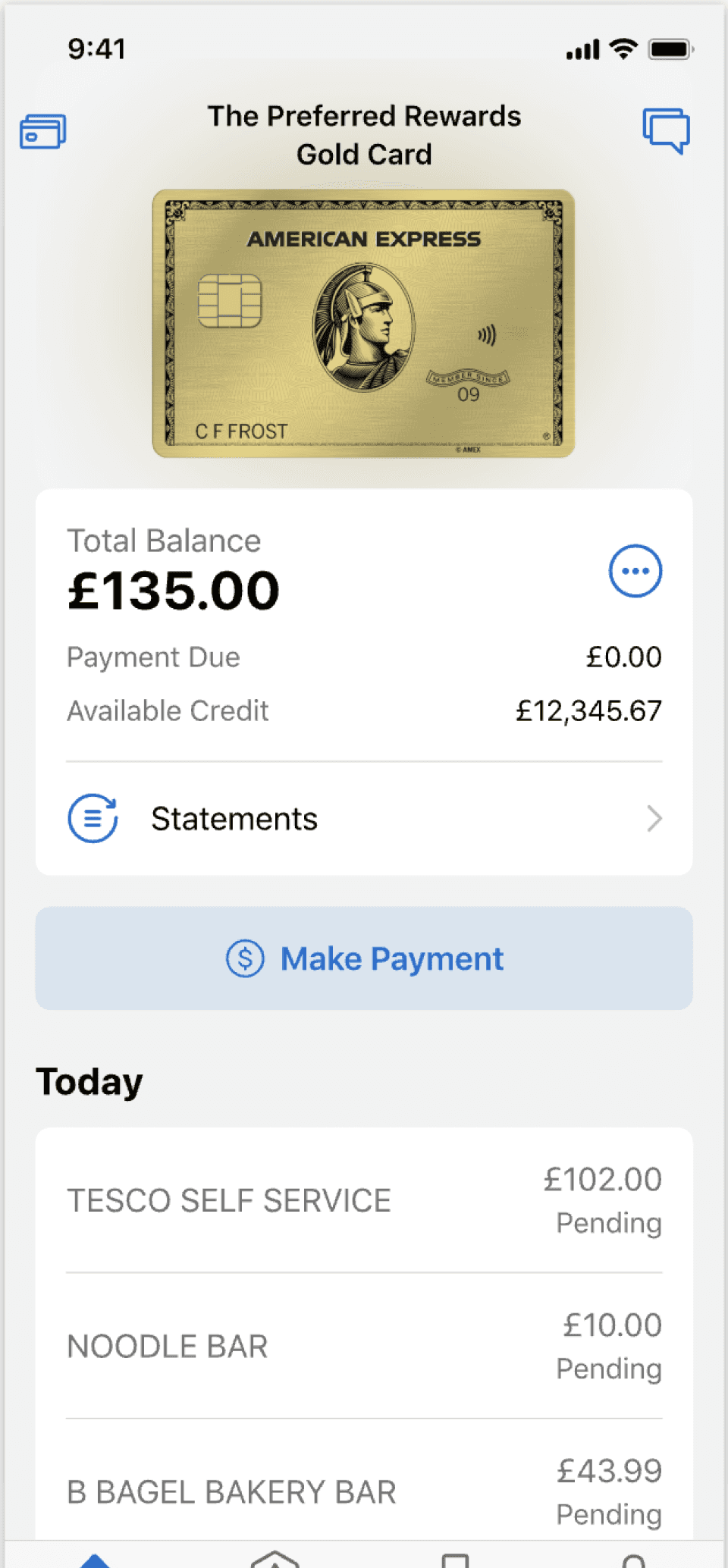

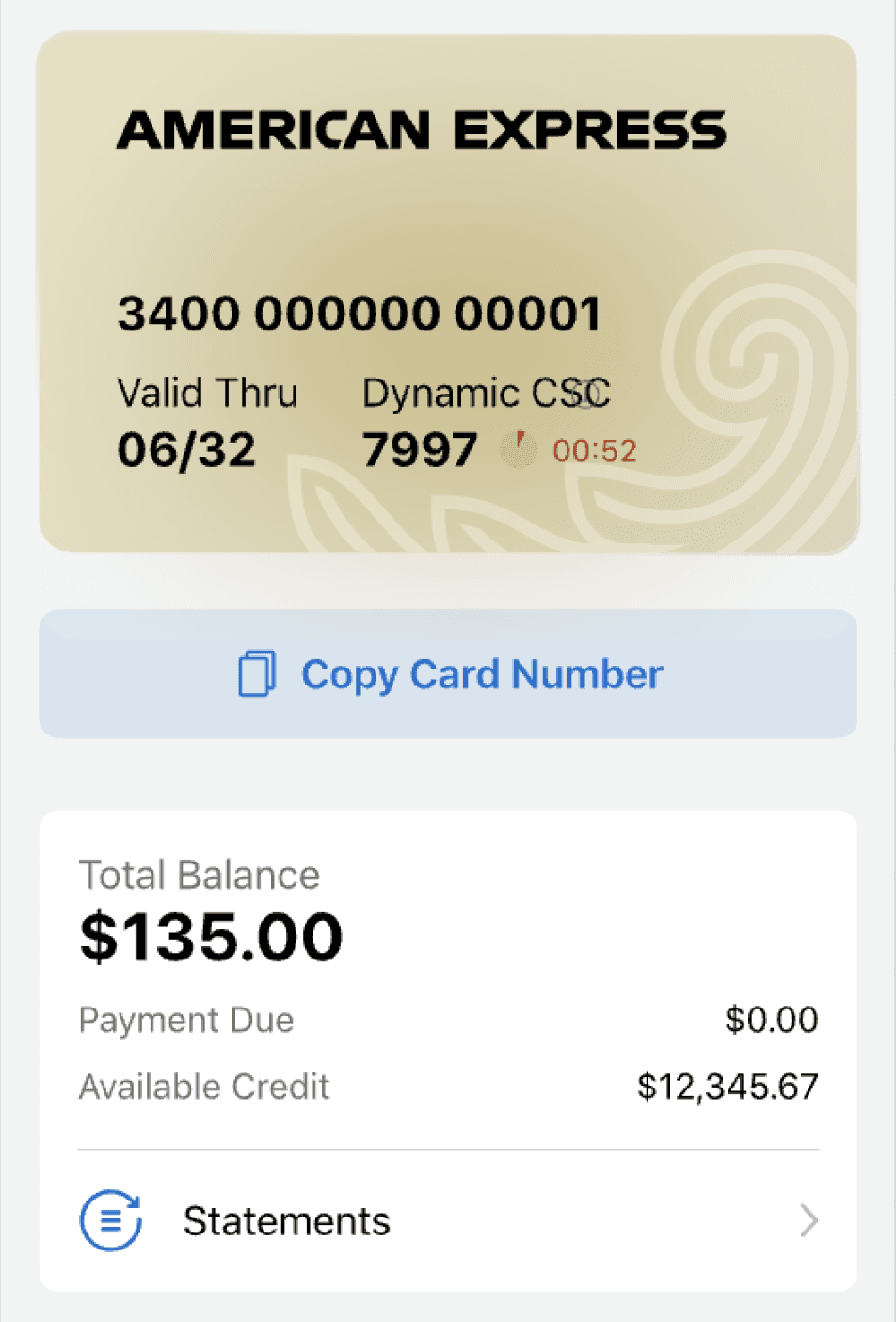

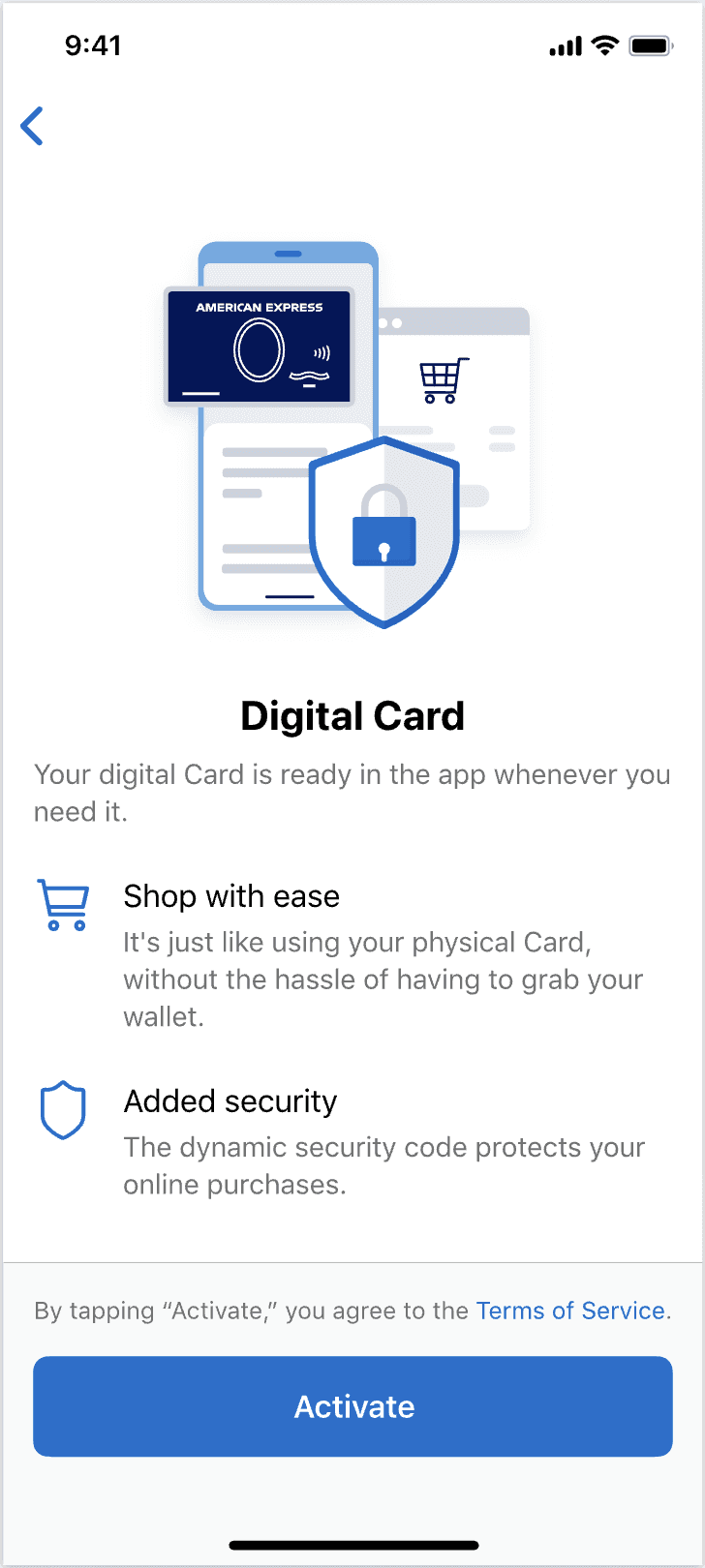

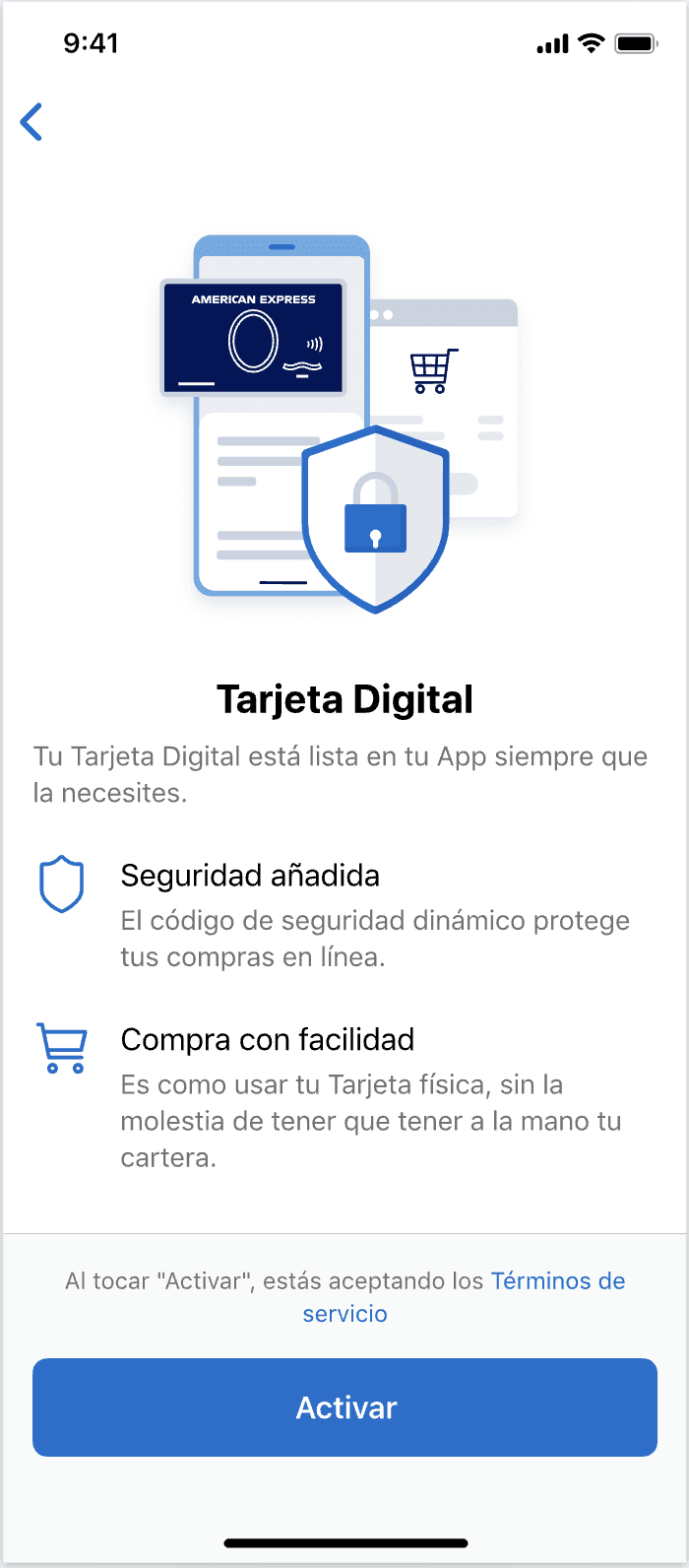

Digital Cards: Secure, Instant Access

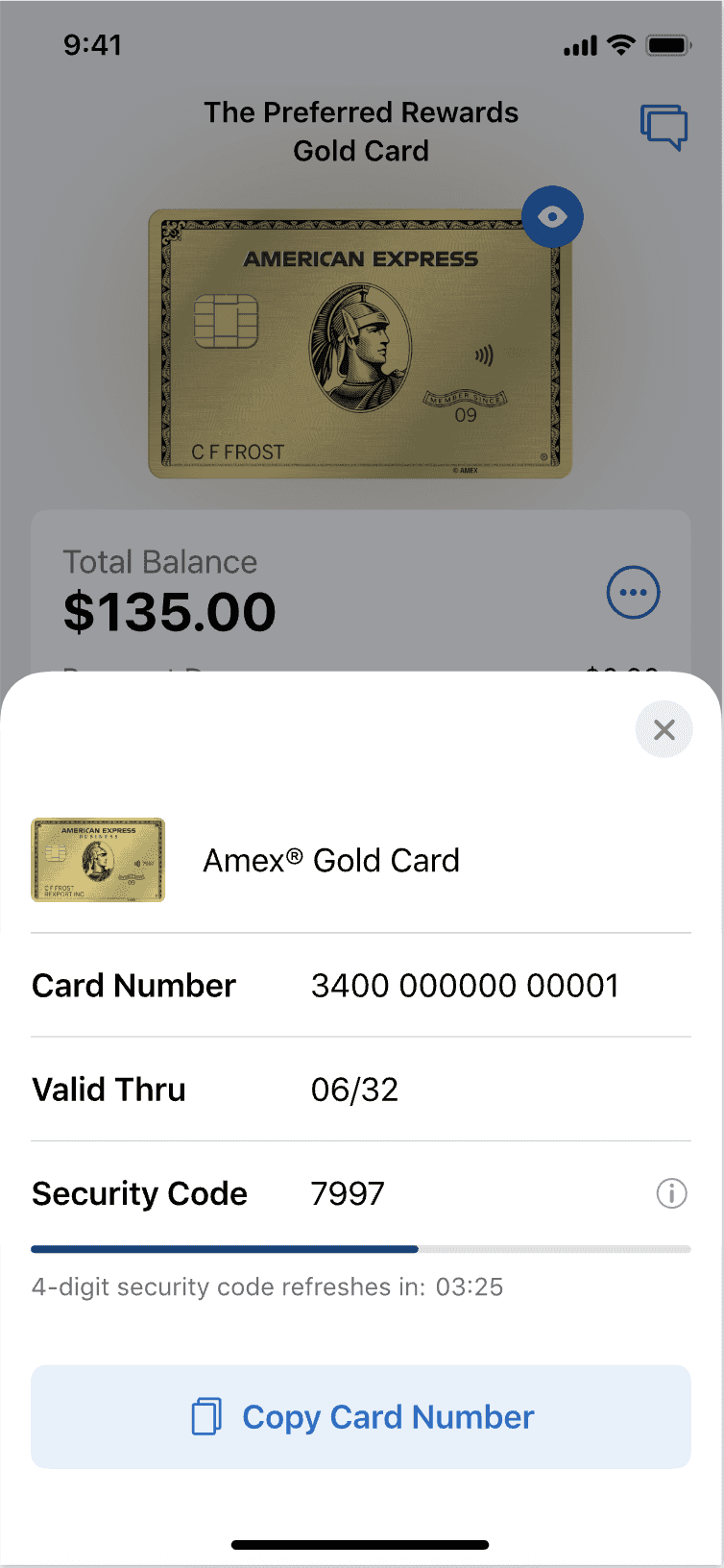

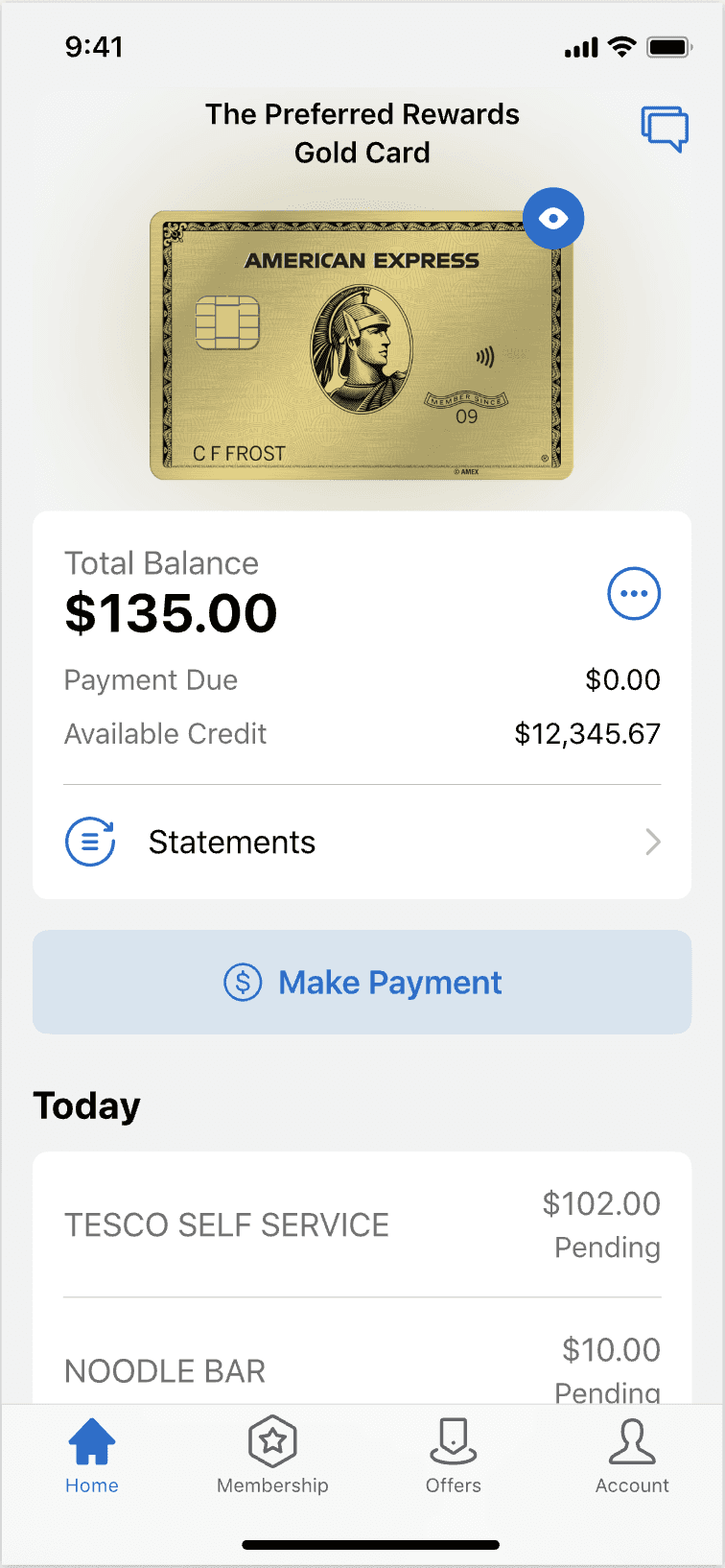

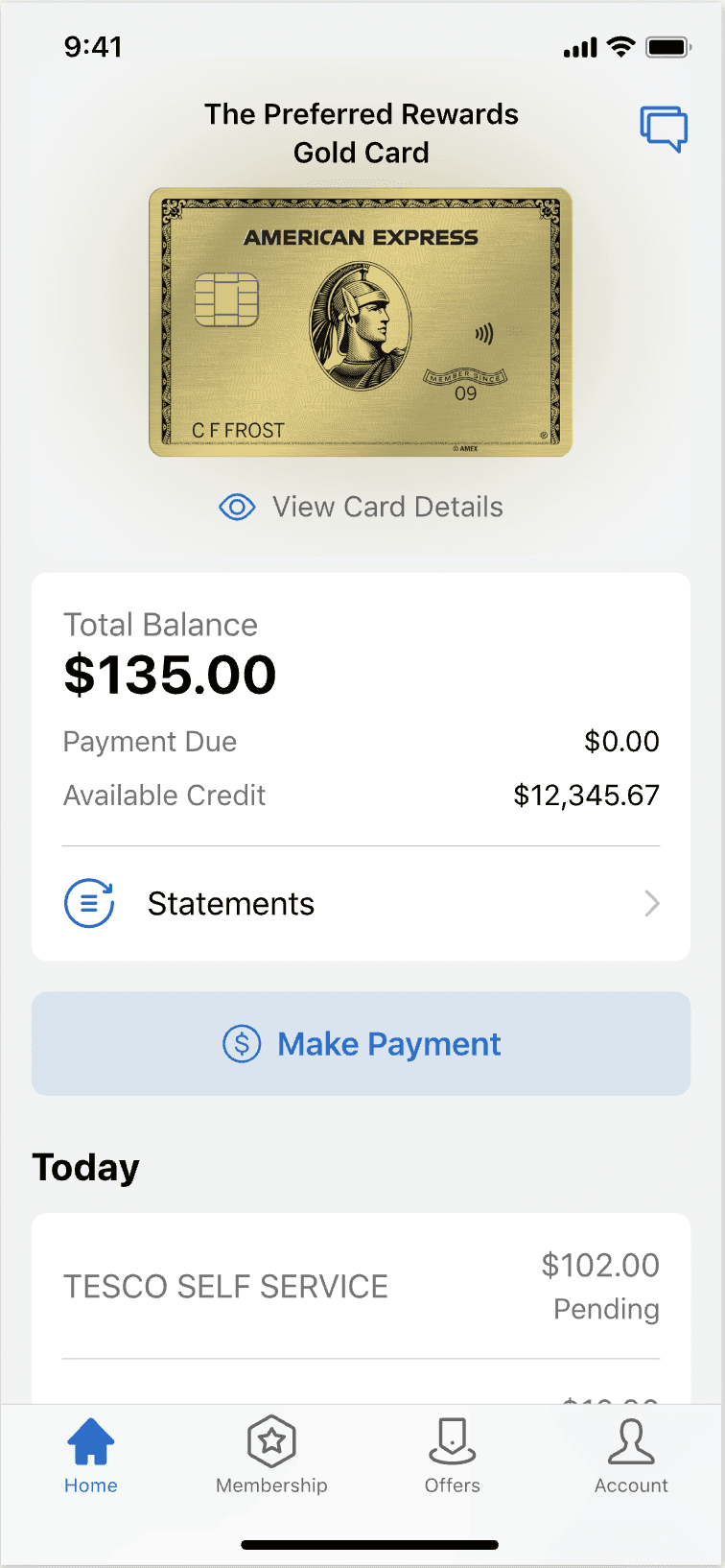

Designed the proof-of-concept for a Digital Card with dynamic security codes that refresh every few minutes to enhance fraud protection.

Designed for instant use of card upon creation, eliminating the wait for physical cards.

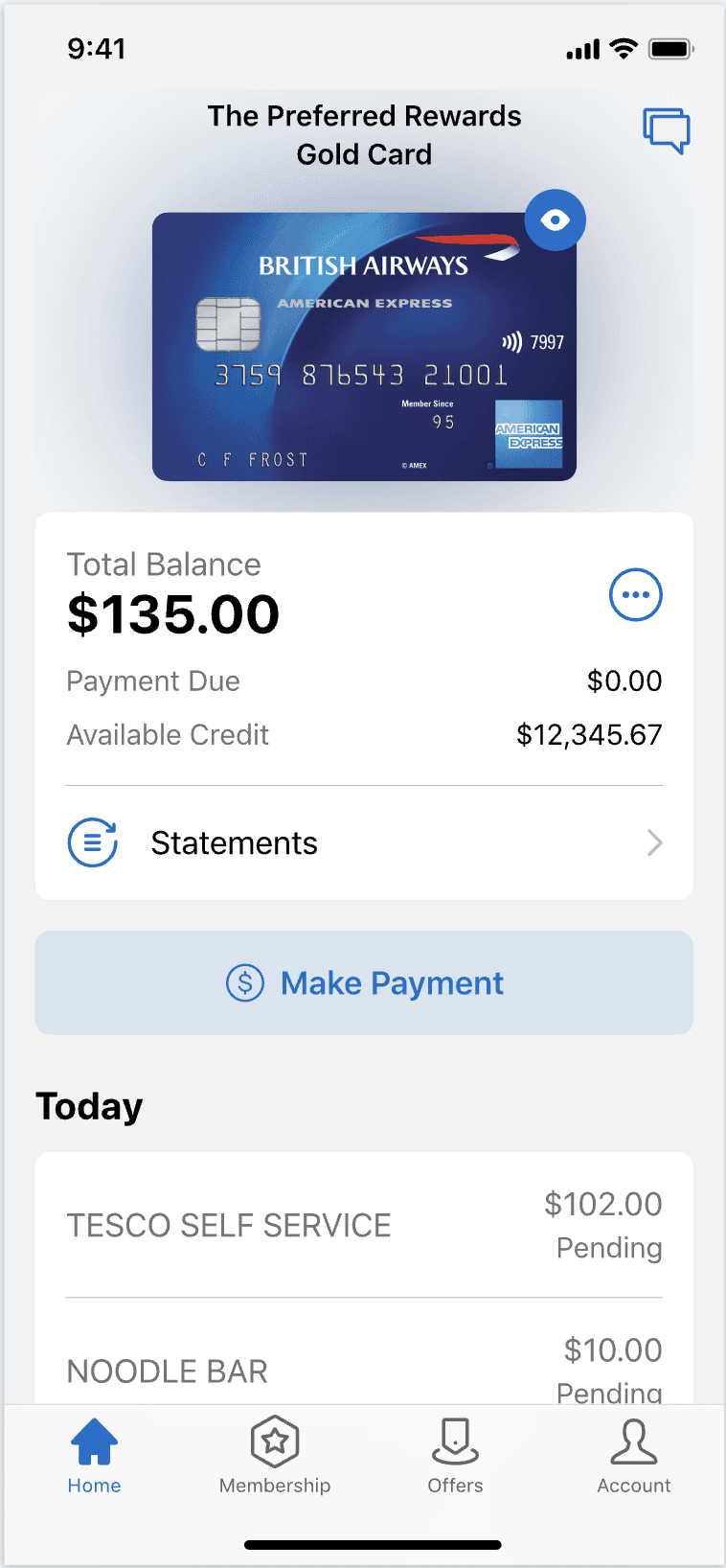

Prepared high-fidelity prototypes for usability testing in the UK and Mexico markets.

Numberless Card: Increase Security & Reduce Fraud

Designed flows for requesting a card without printed card details, with immediate in-app access to card information upon approval.

Created entry points for sign-up, renewal, and replacement journeys.

Prepared high-fidelity prototypes for usability testing in the UK and Mexico markets.

Overview

Market Context

Numberless cards launched by Apple (US, 2019) and Chase (UK, 2021) saw strong adoption.

Business Focus

Growth: Increase digital engagement and share of online spending.

Protection: Reduce fraud and strengthen CardMember trust and loyalty.

Benefit

Fraud Prevention

Another benefit of the Numberless Card is fraud prevention. Approximately 70% of Amex card usage occurs online. Based on gathered data, in 2021, 77% of fraud cases happened with card-not-present transactions. Each fraud or suspected fraud case involves card replacement and a certain amount of fraud loss. This can also decrease servicing calls.

In 2021:

Amex replaced 2.2M cards due to fraud or suspected fraud, at a cost of USD$28M.

Fraud accounted for 26% of total replacements.

Launch Plan

Launch in Mexico

Internal pilot to 20–50 Amex Mexico colleagues before 50K CardMember rollout.

Mexico chosen as launch market due to high demand and competitive landscape (9/11 top players offer virtual cards; 5/11 offer numberless).

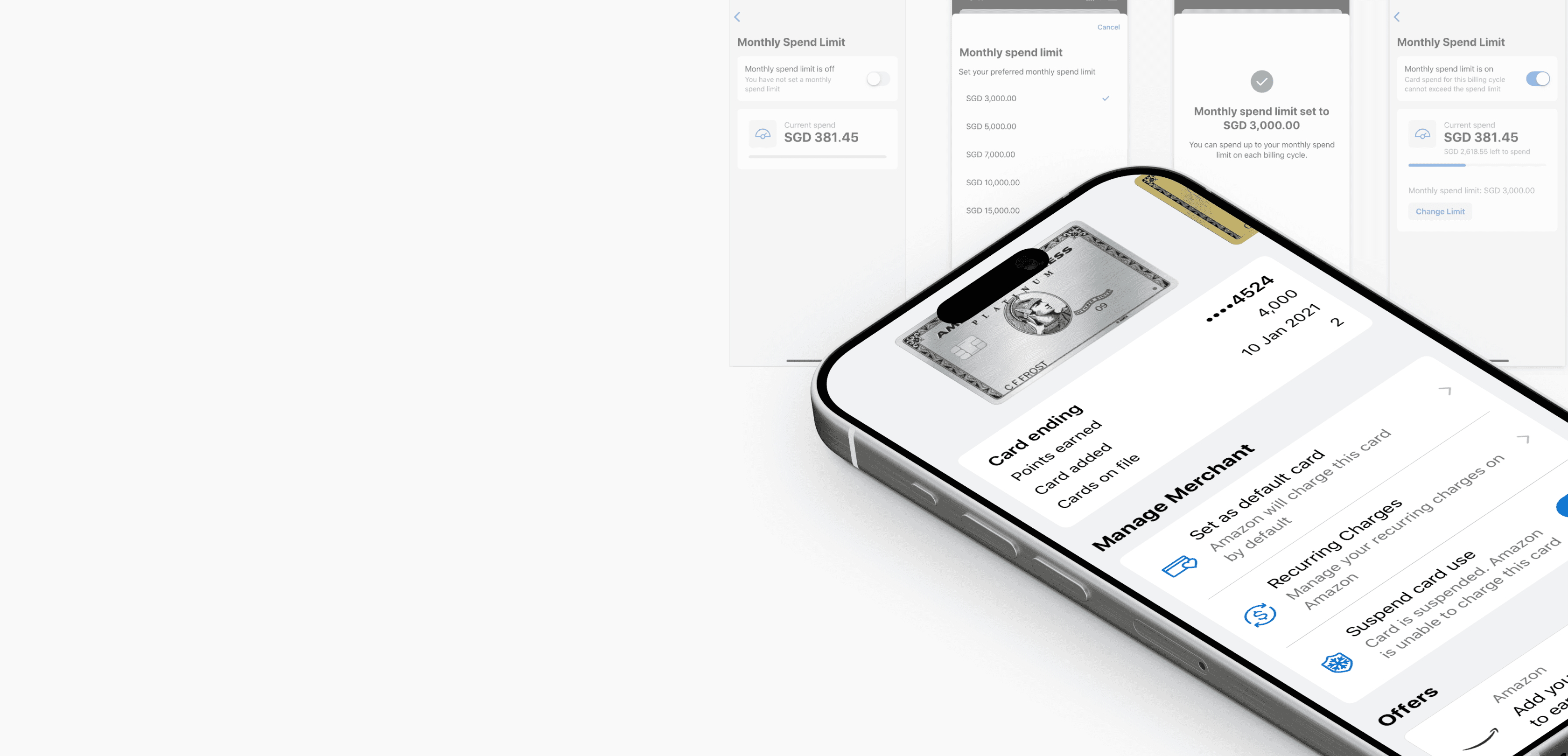

Subscription Hub & Spending Limit (Concept)

Contributed to conceptual designs for a Subscription Hub, allowing CardMembers to view and manage recurring charges in one place, with quick suspend/resume controls.

Explored a Spending Limit feature for budget control and improved spend visibility.

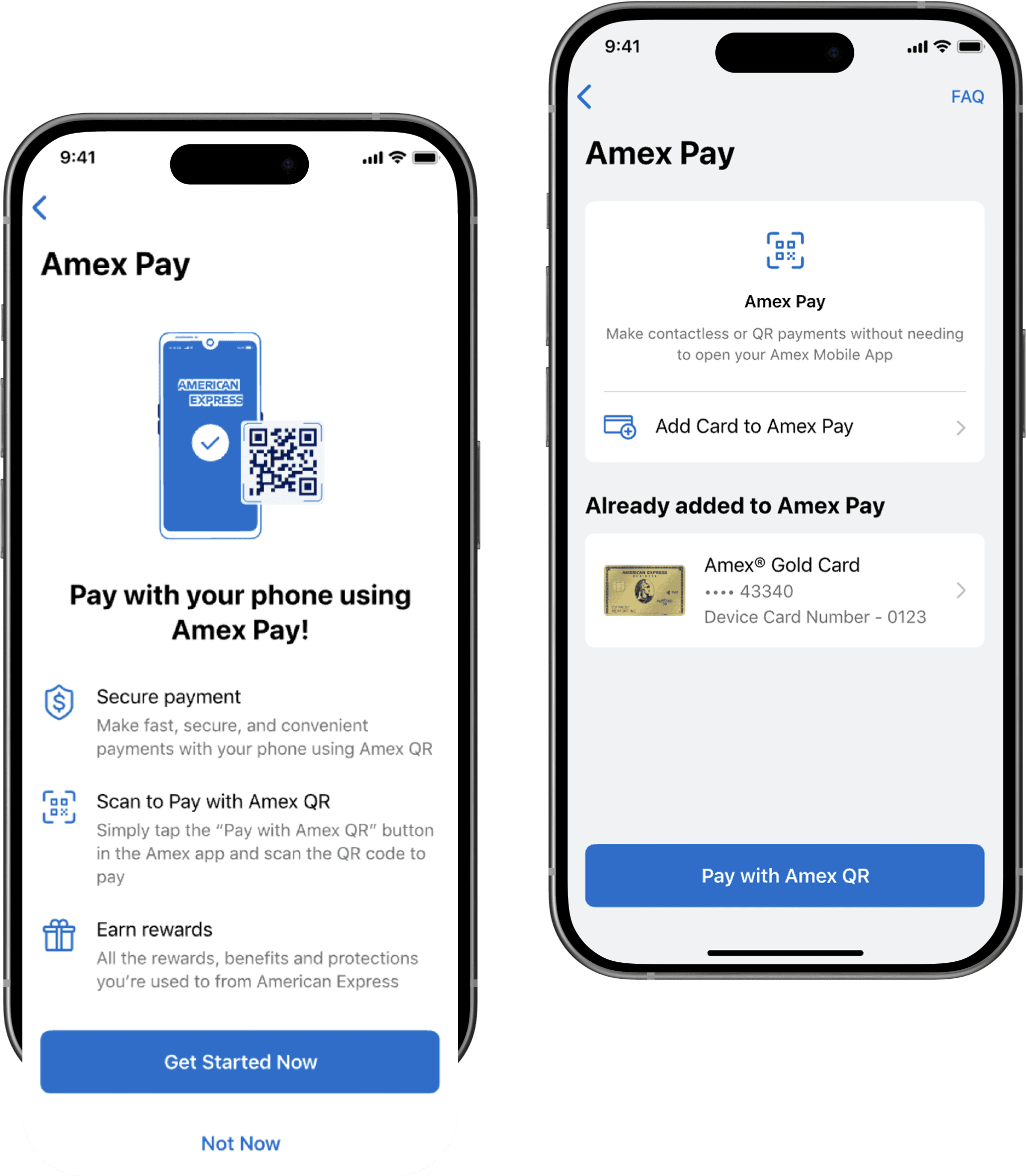

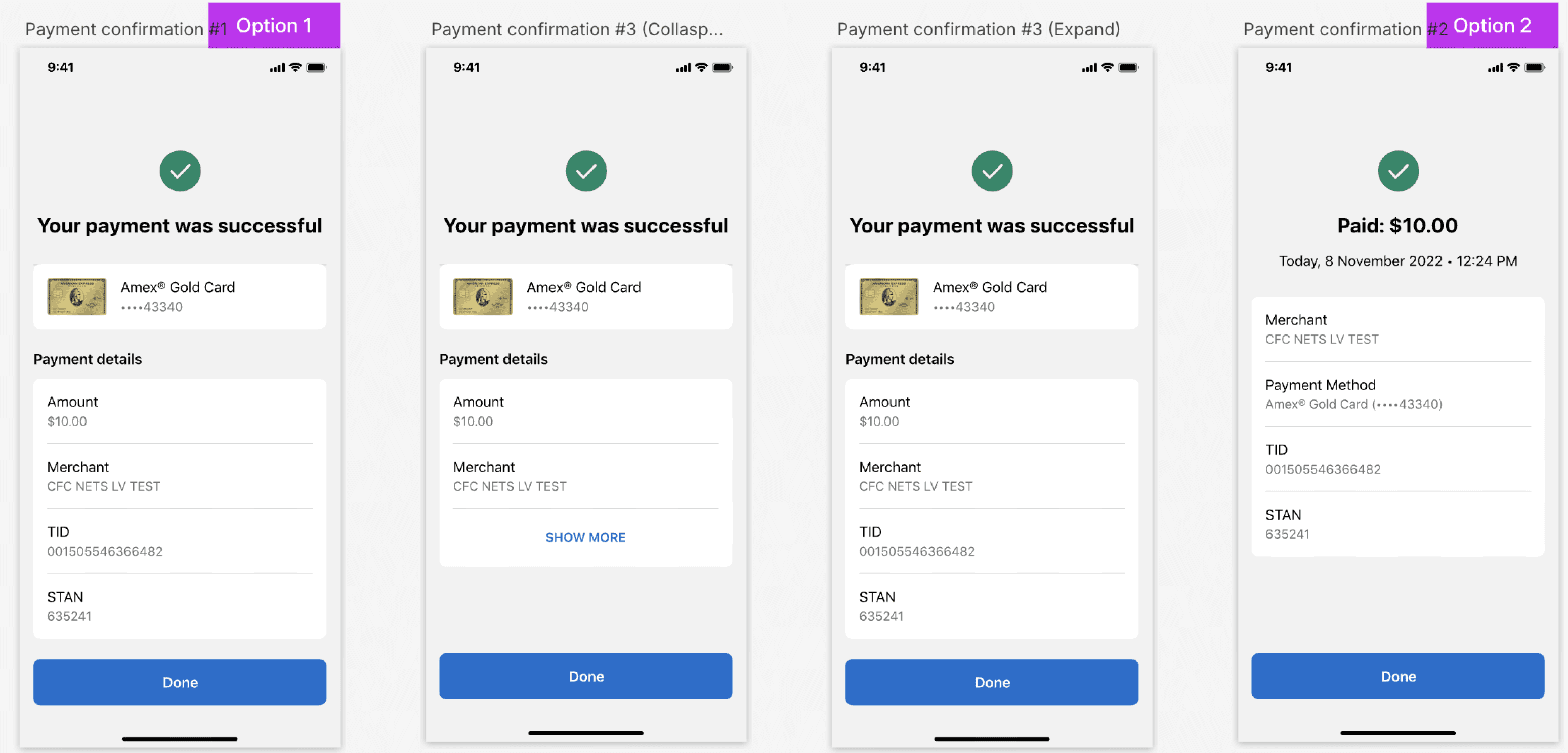

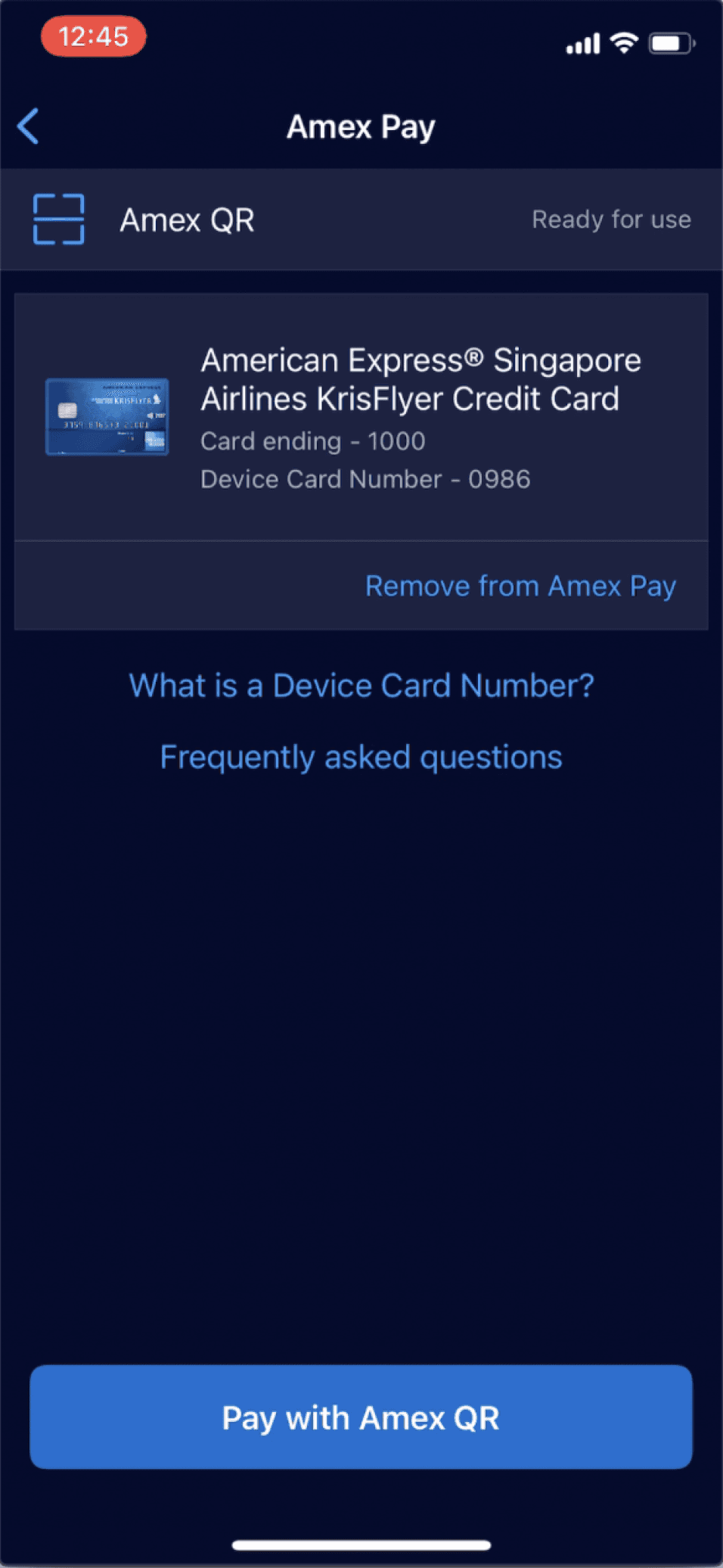

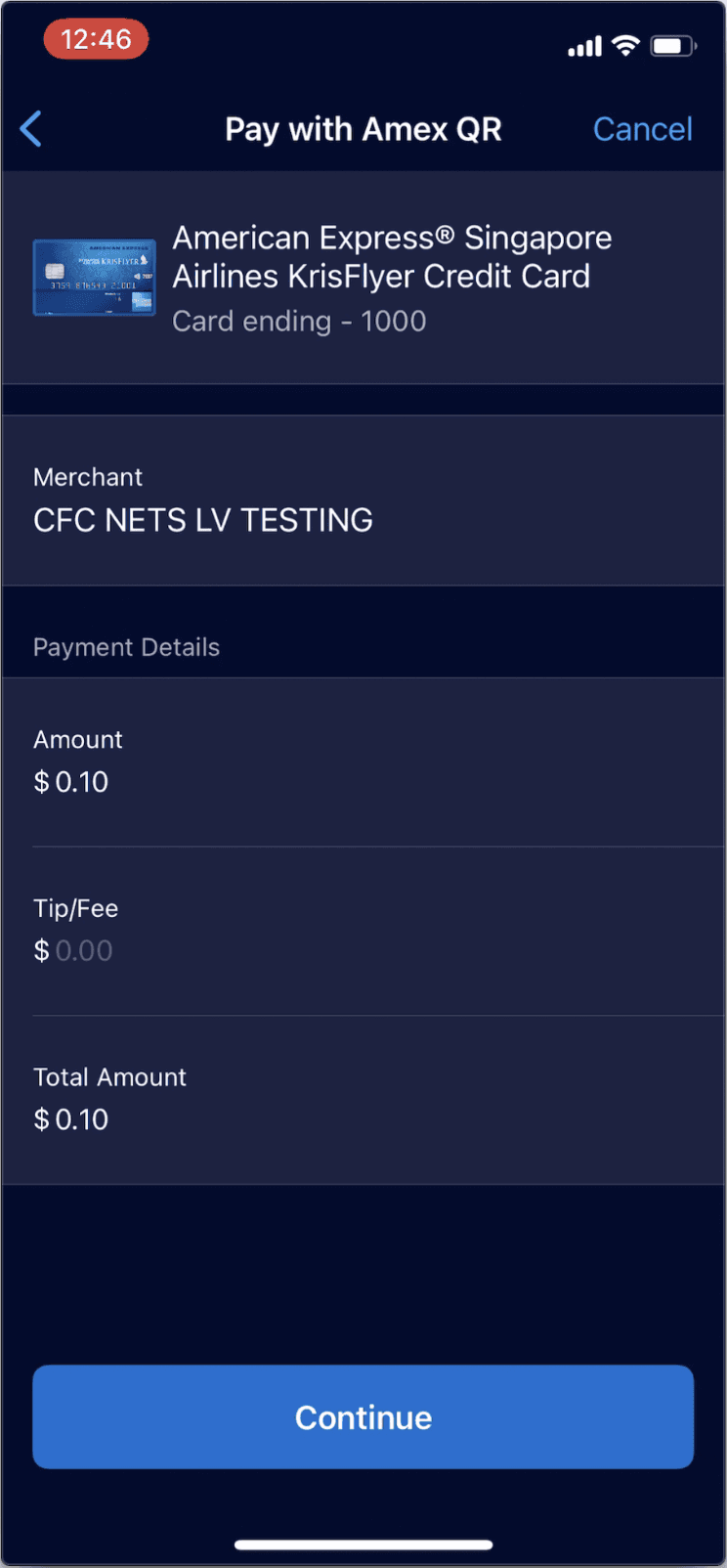

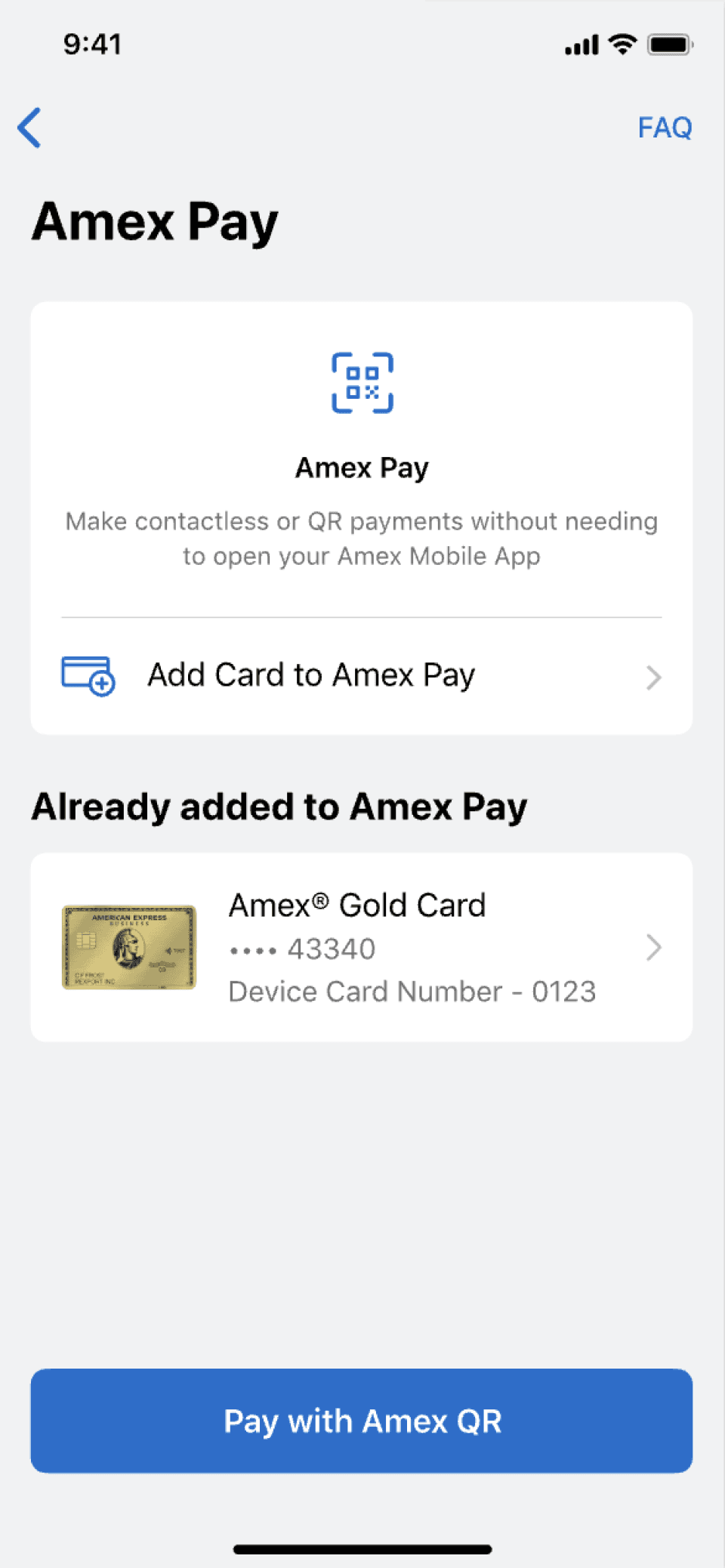

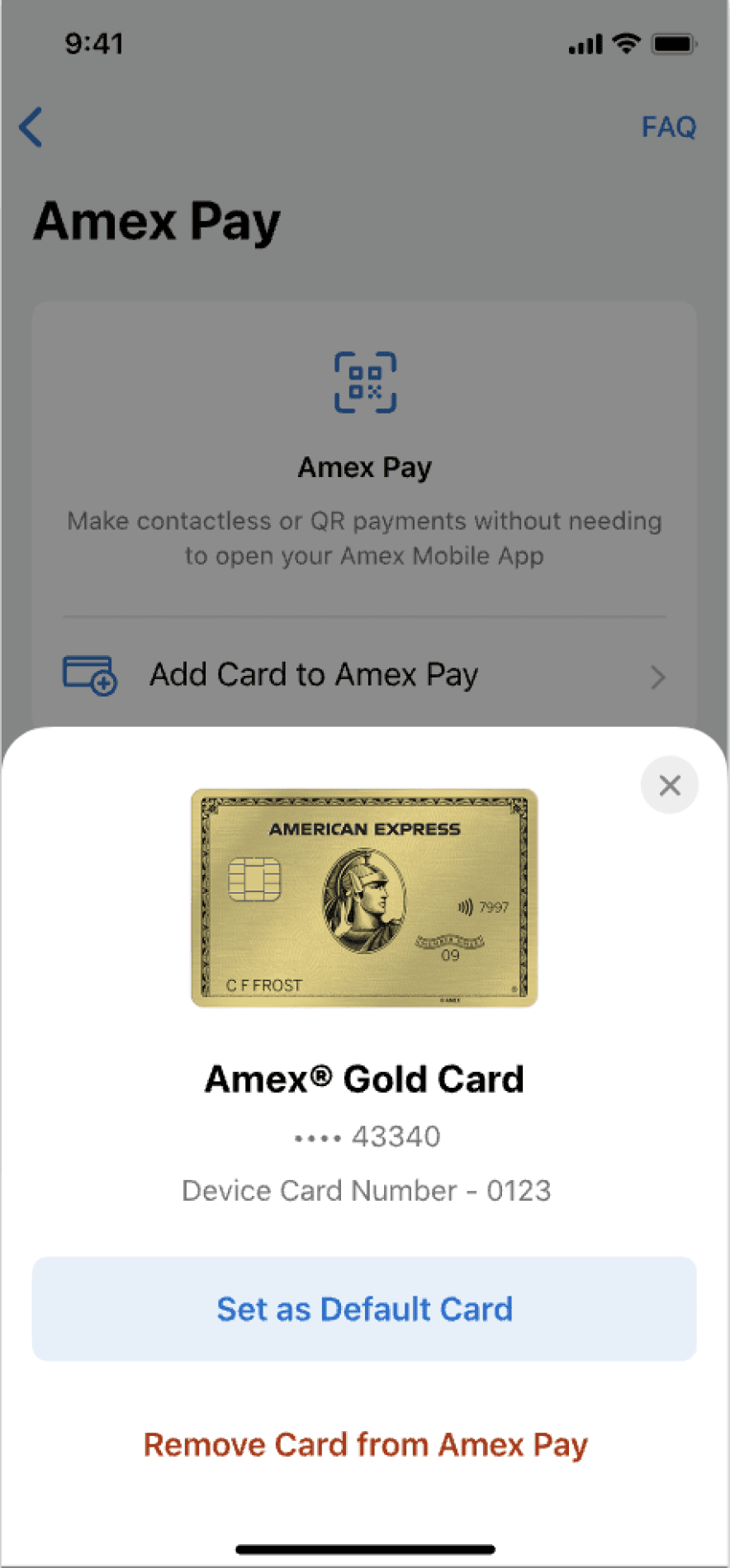

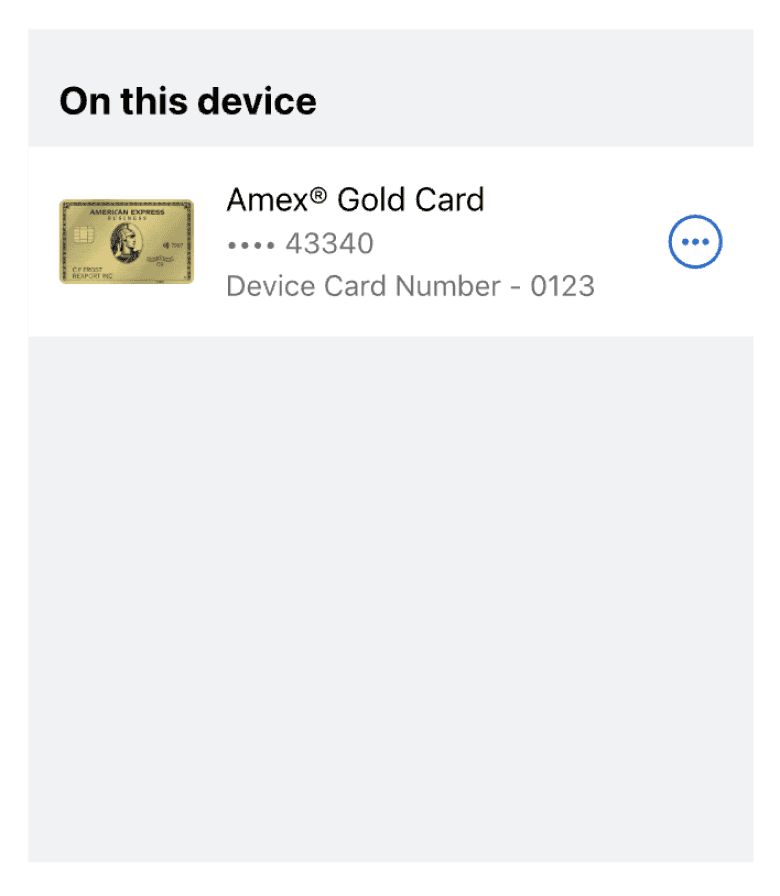

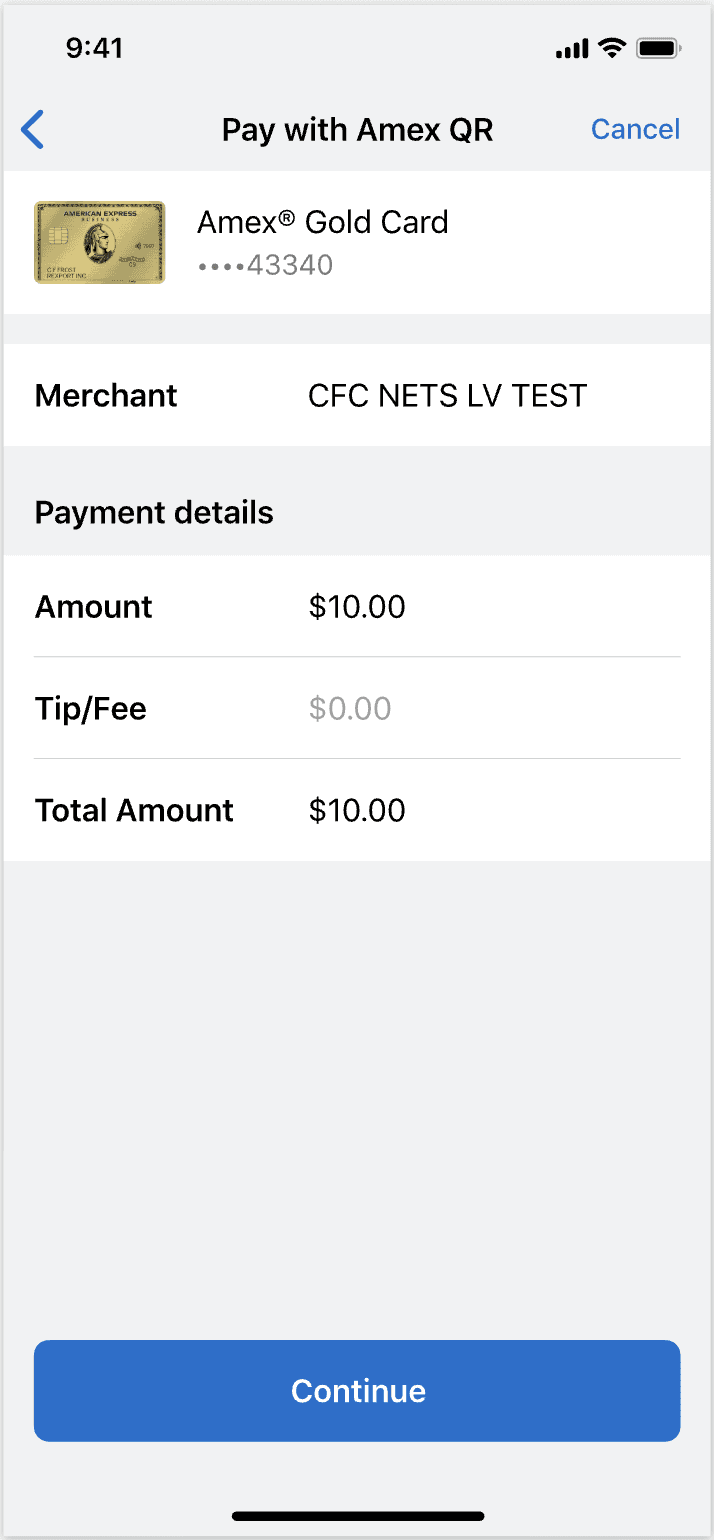

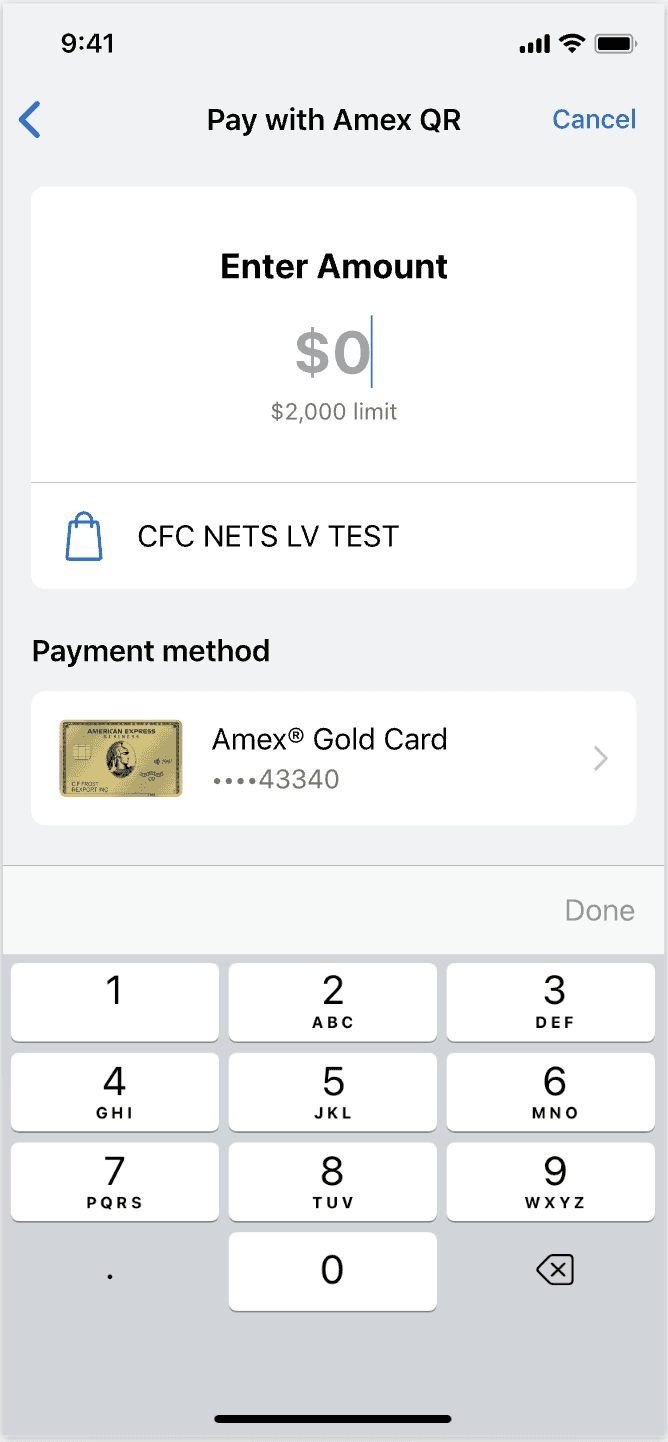

Amex Pay (Singapore & India)

Redesigned the existing experience to align with the latest design patterns and reduce cognitive load by restructuring content.

Streamlined the onboarding process to enable a faster, more intuitive payment journey.

Collaborated with the UX writer and Product Owner to prioritise payment detail data for clarity and ease of use.

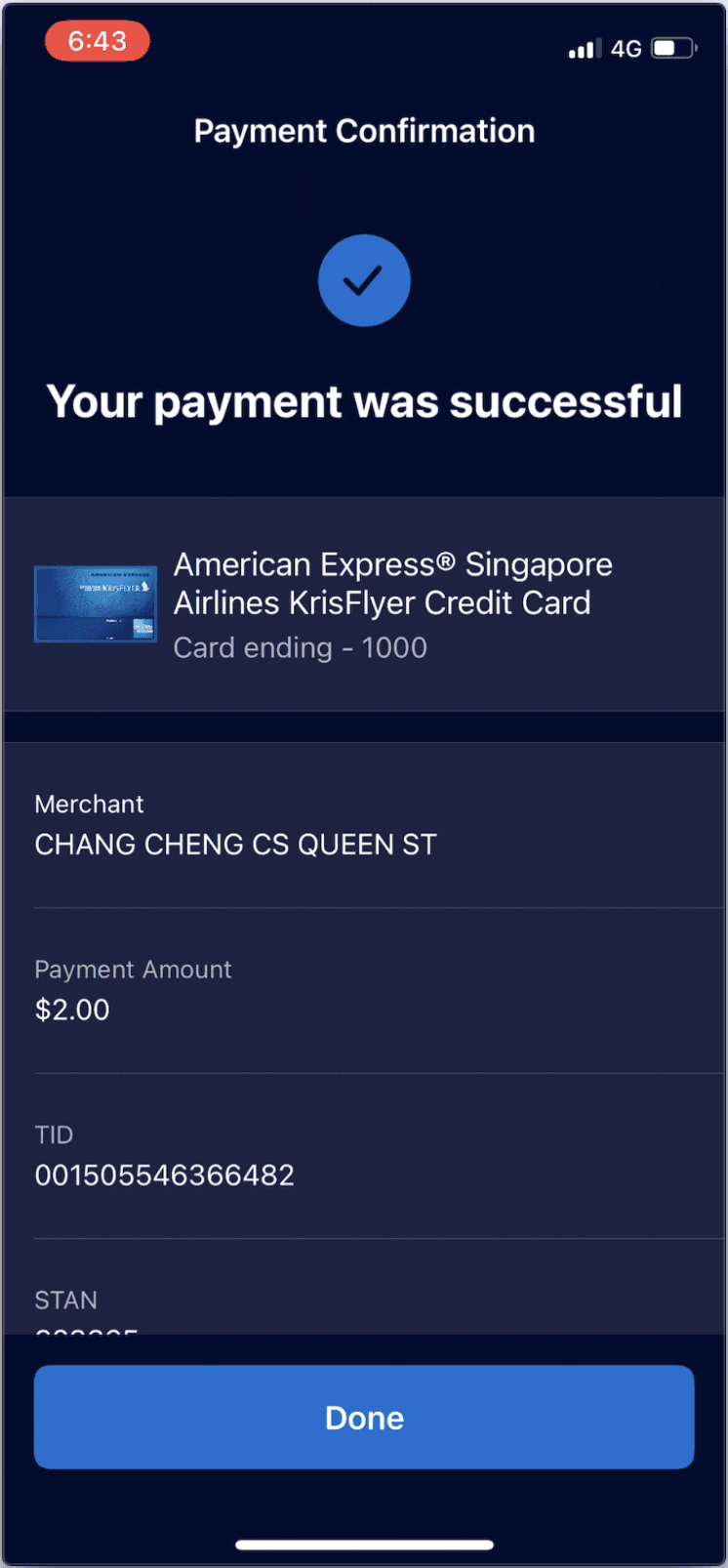

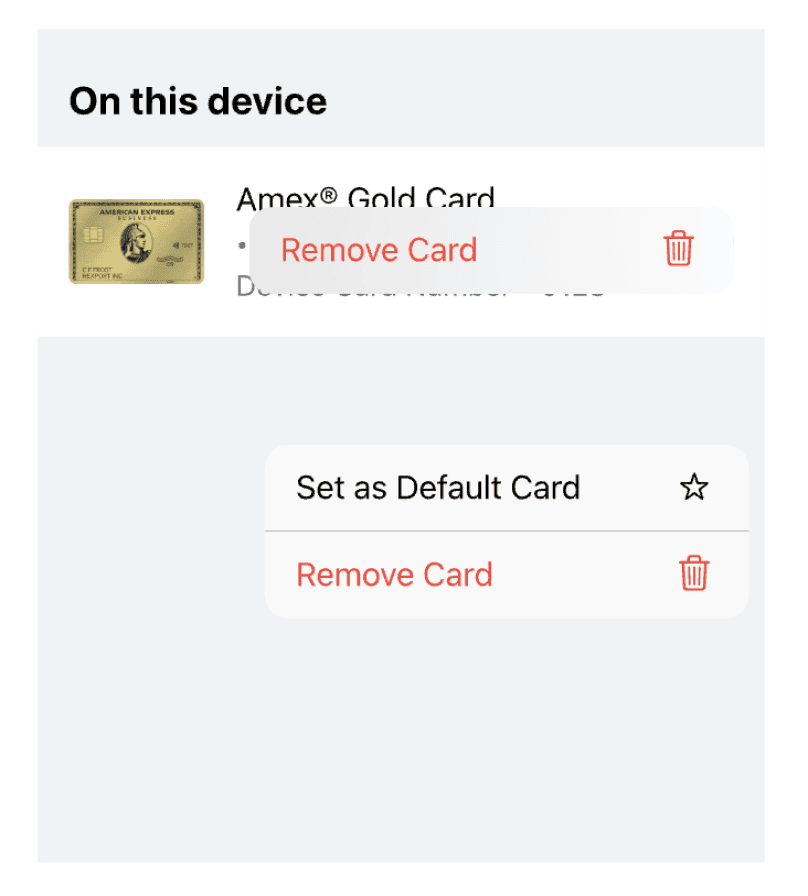

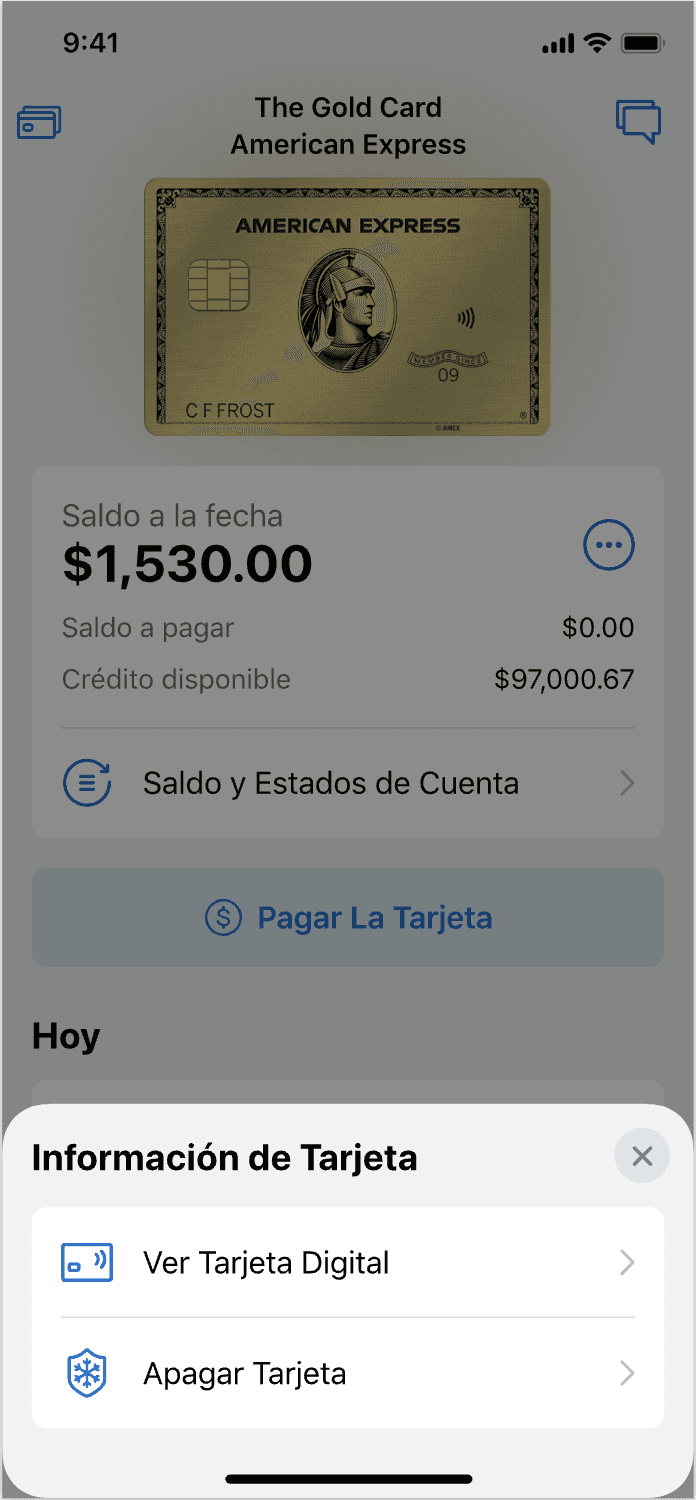

Existing Design (Dark Mode)

Redesign with Explorations

VISUALS FROM MOBILE APP VISION

VISUALS FROM Digital/Numberless Card

Exploring trigger point to view card details while considering colour contrast with Cobranded cards

Illustrations for Digital Card

Future Consideration: Will CardMembers intuitively recognise that tapping the card will reveal its details?

Preparing prototypes for usability testing in the Mexico market

Retrospective

Grateful to have earned the trust to independently lead design calls with Amex’s UK Lead Designer.

As an external vendor, I navigated limited access to internal design resources by proactively syncing with the UK Lead Designer for the latest components and rollout timelines. This ensured usability tests reflected the live experience in each market, avoiding skew from unreleased designs. Without direct QA access, I adapted by using visual comparisons and overlays to maintain design quality.

The project required working across multiple time zones (UK, US, Mexico) and localising designs for each market. Additionally, I had the opportunity to observe first-hand how market research, user research, and usability testing are conducted in the UK — an experience that broadened my perspective on global product design processes.

More works

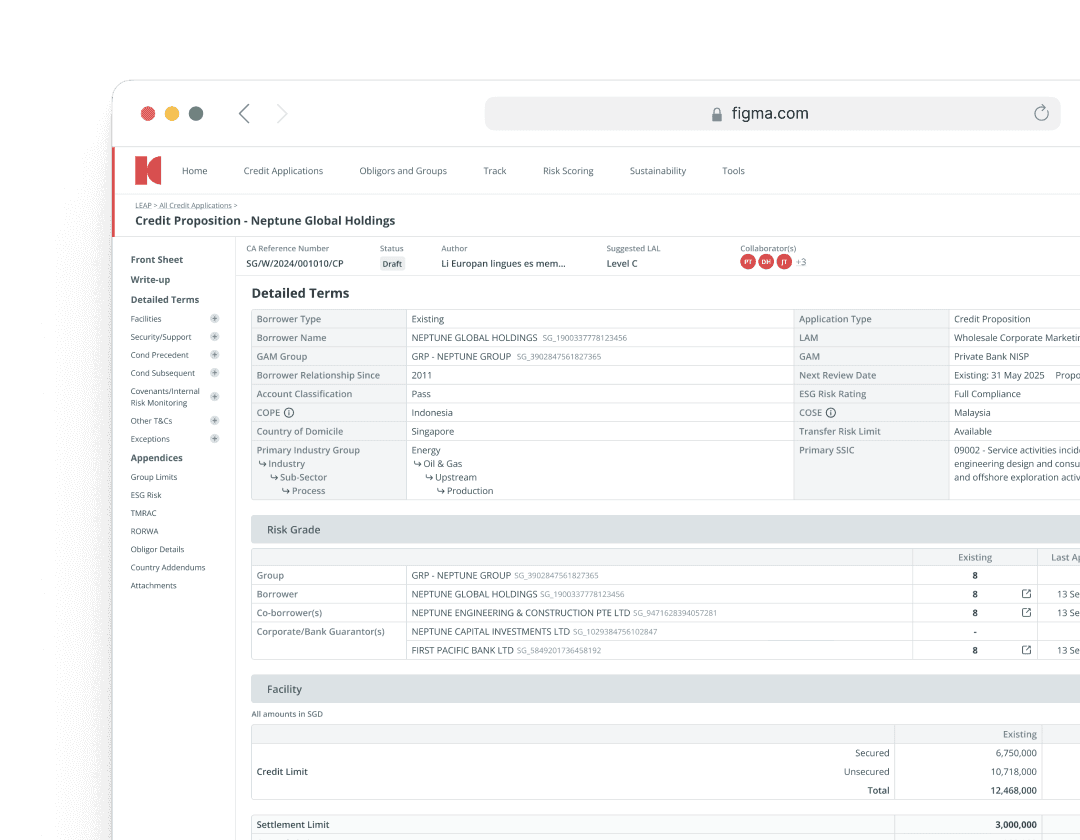

E2E Product Design | UI/UX | Nov 2023 - present

Bank's Loan Origination System

Transforming the Bank’s credit journey for Large Corporates by modernising how Relationship Managers (RMs) raise credit applications.

Responsive Design | UX | 2023

Aqua Expeditions Website Revamp

Redesigned Aqua Expeditions’ website to streamline discovery, improve booking, and align content architecture with user behaviours and business goals.

→